Check out my favorite blog:

Daily Innovention

This website is dedicated to an analysis of the property/casualty insurance industry using the Elliott Wave Theory.

Thursday, September 23, 2010

Pull the plug?

I'm thinking about pulling the plug on this website. I'm not getting any comments or much traffic. It's a lot of work to do research if no one reads it.

I'm going to give it a couple of days. If I receive no comments below, I'll try to place the articles elsewhere and pull the plug.

Thanks,

I'm going to give it a couple of days. If I receive no comments below, I'll try to place the articles elsewhere and pull the plug.

Thanks,

Unemployment

According to the PLRB today, "Employee turnover in claims department has been an issue for a long time, but now it seems to be growing into a larger personnel problem. At a recent meeting, claims managers told us that they are dealing with at least a 33% turnover rate. The loss of 1/3 of the claims department staff creates a dramatic leadership challenge to make the best of the situation."

Wednesday, September 22, 2010

Trade

Sold TZA at 27.33. Usually when the dollar goes down, the market goes up.

When you're not certain where we are in a cycle, it's best to go into cash and see where the market heads. Better to take a small profit than gamble.

When you're not certain where we are in a cycle, it's best to go into cash and see where the market heads. Better to take a small profit than gamble.

Tuesday, September 21, 2010

Trade

Still holding TZA and I'm +1.85%. However, there may still be some life left in this rally. If the rally was over, today's move should have been more forceful. If the market is up tomorrow morning, it will be time to sell.

Monday, September 20, 2010

Underwriting Cycles - Part II

The Nature of Underwriting Cycles

The insurance industry generally holds the perception that underwriting cycles typically run six years from peak to peak or from trough to trough. The industry also seems to hold to the belief that the vacillations of the cycles are generally modest and the trend line is steady.

Using the Elliott Wave Principle, this report applies technical analysis to underwriting cycles. An analysis of the data suggests that the industry’s perceptions of underwriting cycles are not accurate.

Analysis suggests that the industry is currently experiencing a "supercycle" where the industry's combined ratio is trending downward. The combined ratio will likely continue downward for at least another 14 years. While there will be vacillations within the supercycle the next move will be sharply downward.

Elliott Wave Theory

The Elliott Wave Theory is a form of technical analysis that is widely used to predict trends in the financial markets. Since underwriting cycles often function as a reaction to the financial markets (as is shown in Part I of this two-part report), Elliott Wave Theory is ideal for analyzing and forecasting underwriting cycles. Analysis using the Elliott Wave Theory identifies repeating patterns in terms of highs and lows. Each form of a cycle (a wave) consists of “sub-cyles” that operate in the same manner. Each set of sub-cycles can be broken down further and further down to Miniscule cycles.

The longest wave within the Elliott Wave Theory is a "grand supercycle," which spans the course of multiple centuries. No one can say with any certainty where we are within the current grand supercycle because there is not enough historical data to make an evaluation. Labeling the grand supercycle in the following chart is necessarily arbitrary. However, since we can see the movement of the sub-cycles, we do have the ability to forecast the continued movement of the next “sub-cycle,” and future movement within the grand supercycle.

Analysis of Combined Ratios

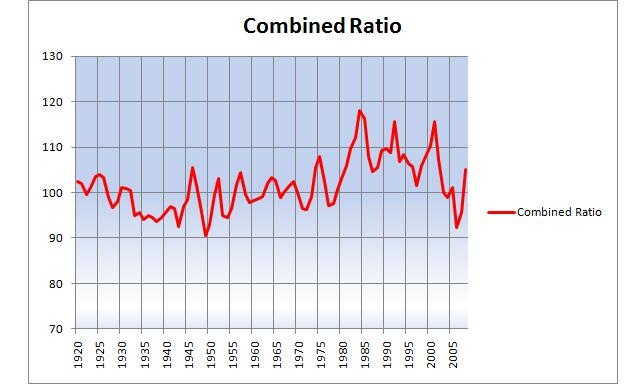

The following is a chart of the industry’s combined ratios from 1920 to 2008. The information was gathered from various editions of A.M. Best Company’s Best’s Aggregates & Averages.

The sub-cycle of a grand supercycle is a "supercycle." In the following graph, we can clearly see the directions of the channels that are cut by the Supercycles. The duration of a supercycles are usually least 40 years, however a supercycle can continue for more than one century. The last completed combined ratio supercycle trended upward from where it began in 1942 and was completed in 1985. (It is noted that these dates coincide somewhat with the supercycle in the financial markets that began in the Great Depression and continued until the bursting of the Dot Com Bubble in 2000. It is remarkable that the industry trend preceded the trend in the financial markets. In an earlier post it was demonstrated that for short term trends, the industry tends to react to markets.)

In 1985, a reversal occurred and the industry entered into a supercycle that is trending downward. As noted above, this trend will likely continue at least 2025.

An underwriting cycle is actually two consecutive sub-cycles of a supercycle - one upward and the other downward. Elliott Wave Theory coincidentally calls these sub-cycles "cycles." The following chart breaks down the supercycles into cycles.

We are currently at the end of an (a) corrective upward wave in within a downward supercycle that I have labeled as an (a) wave of the Supercycle. The next movement will be a (b) move down.

Note that it was recently announced that the year-end combined ratio for 2008 was 105.1. Yet on September 16th, the Property Casualty Insurers Association of America (PCI) issued a press release stating that the combined ratio "deteriorated" to 101.7 percent for six-months 2010 from 100.8 percent for six-months 2009. The movement is hardly a deterioration compared to 2008. Note that small increases within the downward trend are not only expected, but they are required, for the waves to take their course. The data released by PCI serves to reinforce the fact that we have now entered the (b) move down.

Methodology

Future posts with explain in more detail how the workings of the Elliott Wave Theory in more detail.

There are notable limitations in charting Elliott Waves for the industry's combined ratios. The only data available to us are end of the year data compilations. We therefore have only “snapshots.” In contrast, when analysts chart financial markets, they have the advantage of the available daily and hourly data. Waves can be broken down into smaller waves. The financial market information “flows” and the peaks and valleys of the waves are more fully revealed. This perhaps explains why there are some waves in the above chart that seem to have progressed either too high or too low.

One wave that bears mention is (I) in 1946. It should not be higher than (III) in the same supercycle. However, the extremes may be due to the fact that in 1942, Congress passed the Emergency Price Control Act. In an attempt to ward off war-time inflation during World War II, the Act created the Office of Price Administration. The Office prohibited businesses from charging more for commodities than they charged on September 15, 1942. This created an unnatural force from outside the insurance marketplace that limited the natural wave movement. The steep decline in the wave following (I), wave (II), may suggest that once the wartime controls were relaxed, insurers tightened up underwriting standards and/or increased premiums.

Conclusions

The following are the conclusions of the two reports on underwriting cycles:

The insurance industry generally holds the perception that underwriting cycles typically run six years from peak to peak or from trough to trough. The industry also seems to hold to the belief that the vacillations of the cycles are generally modest and the trend line is steady.

Using the Elliott Wave Principle, this report applies technical analysis to underwriting cycles. An analysis of the data suggests that the industry’s perceptions of underwriting cycles are not accurate.

Analysis suggests that the industry is currently experiencing a "supercycle" where the industry's combined ratio is trending downward. The combined ratio will likely continue downward for at least another 14 years. While there will be vacillations within the supercycle the next move will be sharply downward.

Elliott Wave Theory

The Elliott Wave Theory is a form of technical analysis that is widely used to predict trends in the financial markets. Since underwriting cycles often function as a reaction to the financial markets (as is shown in Part I of this two-part report), Elliott Wave Theory is ideal for analyzing and forecasting underwriting cycles. Analysis using the Elliott Wave Theory identifies repeating patterns in terms of highs and lows. Each form of a cycle (a wave) consists of “sub-cyles” that operate in the same manner. Each set of sub-cycles can be broken down further and further down to Miniscule cycles.

The longest wave within the Elliott Wave Theory is a "grand supercycle," which spans the course of multiple centuries. No one can say with any certainty where we are within the current grand supercycle because there is not enough historical data to make an evaluation. Labeling the grand supercycle in the following chart is necessarily arbitrary. However, since we can see the movement of the sub-cycles, we do have the ability to forecast the continued movement of the next “sub-cycle,” and future movement within the grand supercycle.

Analysis of Combined Ratios

The following is a chart of the industry’s combined ratios from 1920 to 2008. The information was gathered from various editions of A.M. Best Company’s Best’s Aggregates & Averages.

The sub-cycle of a grand supercycle is a "supercycle." In the following graph, we can clearly see the directions of the channels that are cut by the Supercycles. The duration of a supercycles are usually least 40 years, however a supercycle can continue for more than one century. The last completed combined ratio supercycle trended upward from where it began in 1942 and was completed in 1985. (It is noted that these dates coincide somewhat with the supercycle in the financial markets that began in the Great Depression and continued until the bursting of the Dot Com Bubble in 2000. It is remarkable that the industry trend preceded the trend in the financial markets. In an earlier post it was demonstrated that for short term trends, the industry tends to react to markets.)

In 1985, a reversal occurred and the industry entered into a supercycle that is trending downward. As noted above, this trend will likely continue at least 2025.

An underwriting cycle is actually two consecutive sub-cycles of a supercycle - one upward and the other downward. Elliott Wave Theory coincidentally calls these sub-cycles "cycles." The following chart breaks down the supercycles into cycles.

We are currently at the end of an (a) corrective upward wave in within a downward supercycle that I have labeled as an (a) wave of the Supercycle. The next movement will be a (b) move down.

Note that it was recently announced that the year-end combined ratio for 2008 was 105.1. Yet on September 16th, the Property Casualty Insurers Association of America (PCI) issued a press release stating that the combined ratio "deteriorated" to 101.7 percent for six-months 2010 from 100.8 percent for six-months 2009. The movement is hardly a deterioration compared to 2008. Note that small increases within the downward trend are not only expected, but they are required, for the waves to take their course. The data released by PCI serves to reinforce the fact that we have now entered the (b) move down.

Methodology

Future posts with explain in more detail how the workings of the Elliott Wave Theory in more detail.

There are notable limitations in charting Elliott Waves for the industry's combined ratios. The only data available to us are end of the year data compilations. We therefore have only “snapshots.” In contrast, when analysts chart financial markets, they have the advantage of the available daily and hourly data. Waves can be broken down into smaller waves. The financial market information “flows” and the peaks and valleys of the waves are more fully revealed. This perhaps explains why there are some waves in the above chart that seem to have progressed either too high or too low.

One wave that bears mention is (I) in 1946. It should not be higher than (III) in the same supercycle. However, the extremes may be due to the fact that in 1942, Congress passed the Emergency Price Control Act. In an attempt to ward off war-time inflation during World War II, the Act created the Office of Price Administration. The Office prohibited businesses from charging more for commodities than they charged on September 15, 1942. This created an unnatural force from outside the insurance marketplace that limited the natural wave movement. The steep decline in the wave following (I), wave (II), may suggest that once the wartime controls were relaxed, insurers tightened up underwriting standards and/or increased premiums.

Conclusions

The following are the conclusions of the two reports on underwriting cycles:

- The industry is incorrect in its belief that the trend lines of underwriting cycles oscillate steadily along a horizontal axis;

- During the last thirty years the industry has done a good job in reacting to economic downturns;

- The industry has been reactive, but not proactive;

- Combined ratios are in the midst of a downward supercycle that will likely continue for at least another 14 years; and

- The next movement has already begun and it will be downward.

Market Top Today?

I believe that we are very close to a top. The safest thing to do in the coming decline is to stay in cash. However, there are ways to make money when the markets go down. I trade in an IRA, in which I am unable to go short. However, by the close of the market today, I expect to buy TZA, which is an exchange traded fund (ETF) .

There are several ETFs, but I am going with TZA since it is based on the performance of the Russell 2000 index. The index has many small cap companies in it, and they are the most overpriced. TZA is designed to move 300 percent of the inverse (the opposite) direction of the Russell index. Trading in this manner can be very dangerous if you don't have a good idea where the market is headed.

As with the End of Days, no one knows the hour or the day, but we do believe that it's coming.

I will post my trades in real-time.

There are several ETFs, but I am going with TZA since it is based on the performance of the Russell 2000 index. The index has many small cap companies in it, and they are the most overpriced. TZA is designed to move 300 percent of the inverse (the opposite) direction of the Russell index. Trading in this manner can be very dangerous if you don't have a good idea where the market is headed.

As with the End of Days, no one knows the hour or the day, but we do believe that it's coming.

I will post my trades in real-time.

Wednesday, September 15, 2010

Kiss Your Retirement Goodbye

Check out the enclosed link.

It describes a study conducted by Boston College's Center for Retirement Research. It says that Americans generally don't have enough saved for retirement. According to the study workers between 32 and 64 are short by a total of $6.6 trillion.

Well, that's scary enough. However, when you read more you find out that the study arrived at the amount "using conservative assumptions, including a 3 percent rate of return on assets and no further cuts in pension coverage or increases in the Social Security retirement age."

If the stock markets are about to undergo a radical decline, where are Americans going to get that modest 3 percent interest? It won't be IRAs or 401ks that are loaded with stocks or mutual funds.

How many people will be able to retire if they lose half of their life savings over the next few years?

Saturday, September 11, 2010

Underwriting Cycles - Part I

The Relationship Between Underwriting Cylces and the Financial Markets

In James Olsen’s excellent textbook, Finance for Risk Management and Insurance Professionals (the required text for CPCU-540), he points to three factors that influence underwriting cycles. The factors are investment income, capacity, and return on equity. Olsen importantly points out that investment income can offset underwriting losses. It is investment income on which this report is focused (Note that both capacity and return on equity are both affected by investment income).

Though the financial markets have had their ups and downs, the Gross Domestic Product has grown steadily since 1956, from $437.4 billion, to $14.4 trillion in 2008. Not factoring for inflation, the GDP never went down in any single year – until 2009. The stock market too, trended upward as a "Supercycle" starting with the depths of the Great Depression and ending with the bursting of the Dot Com Bubble in March 2000.

The objective of this report is to analyze whether the underwriting cycle has moved in response to the financial markets.

When financial markets decline, it is indisputably beneficial for combined ratios to decrease. It can also be argued that profits can be maximized by increased combined ratios, during times of prosperity, in order to increase the availability of investment funds.

It should be emphasized, however, that stocks make up only about 10 - 12 percent of insurers' assets.

Analysis

This report (the first of two parts) compares the historical movement of the Dow Jones to the movements of underwriting cycles.

Combined Ratio information was gatthered from various editions of A.M. Best Company’s Best’s Aggregates & Averages.

Since the industry-wide combined ratio information is based on end of the year data, this report uses the Dow prices as of the last day of each year.

The following graph shows the industry-wide combined ratios from 1920 to 2008.

It is interesting to note that between 1929 and 1932, the first years of the Great Depression, The industry incurred an underwriting loss. It took the industry a few years to react (presumably by tightening underwriting standards), but by the worst year of the Depression, the industry started to turn things around. By 1934 the industry was making an underwriting profit of more than 4 percent. By 1935, the industry achieved a combined ratio of .94.

The next graph shows the performance of the Dow overlaying the graph of the combined ratios. Please note that the two charts are not to scale. The combined ratios operate in a narrow range, more or less, anchored to 1.0, while the Dow has increased so much over the last twenty years that even the Great Depression is hardly noticeable on the chart.

For example, in looking at the above graph it appears that there was little growth or volatility from 1956 to the late 1970s. Without taking a closer look, it would otherwise appear that insurers would not have needed to react to drastic changes in the financial markets during those years. However, the graph is deceiving. The earlier years look flat in this first graph not only because of the increase in real value, but also because of the inflation, wild fluctuations, and wild growth of the later years.

In James Olsen’s excellent textbook, Finance for Risk Management and Insurance Professionals (the required text for CPCU-540), he points to three factors that influence underwriting cycles. The factors are investment income, capacity, and return on equity. Olsen importantly points out that investment income can offset underwriting losses. It is investment income on which this report is focused (Note that both capacity and return on equity are both affected by investment income).

Though the financial markets have had their ups and downs, the Gross Domestic Product has grown steadily since 1956, from $437.4 billion, to $14.4 trillion in 2008. Not factoring for inflation, the GDP never went down in any single year – until 2009. The stock market too, trended upward as a "Supercycle" starting with the depths of the Great Depression and ending with the bursting of the Dot Com Bubble in March 2000.

The objective of this report is to analyze whether the underwriting cycle has moved in response to the financial markets.

When financial markets decline, it is indisputably beneficial for combined ratios to decrease. It can also be argued that profits can be maximized by increased combined ratios, during times of prosperity, in order to increase the availability of investment funds.

It should be emphasized, however, that stocks make up only about 10 - 12 percent of insurers' assets.

Analysis

This report (the first of two parts) compares the historical movement of the Dow Jones to the movements of underwriting cycles.

Combined Ratio information was gatthered from various editions of A.M. Best Company’s Best’s Aggregates & Averages.

Since the industry-wide combined ratio information is based on end of the year data, this report uses the Dow prices as of the last day of each year.

The following graph shows the industry-wide combined ratios from 1920 to 2008.

It is interesting to note that between 1929 and 1932, the first years of the Great Depression, The industry incurred an underwriting loss. It took the industry a few years to react (presumably by tightening underwriting standards), but by the worst year of the Depression, the industry started to turn things around. By 1934 the industry was making an underwriting profit of more than 4 percent. By 1935, the industry achieved a combined ratio of .94.

The next graph shows the performance of the Dow overlaying the graph of the combined ratios. Please note that the two charts are not to scale. The combined ratios operate in a narrow range, more or less, anchored to 1.0, while the Dow has increased so much over the last twenty years that even the Great Depression is hardly noticeable on the chart.

For example, in looking at the above graph it appears that there was little growth or volatility from 1956 to the late 1970s. Without taking a closer look, it would otherwise appear that insurers would not have needed to react to drastic changes in the financial markets during those years. However, the graph is deceiving. The earlier years look flat in this first graph not only because of the increase in real value, but also because of the inflation, wild fluctuations, and wild growth of the later years.

The following is a graph of the Dow from 1957 to 1967.

A closer inspection shows that there have significant percentage swings - smaller cycles comprising the larger supercylce. For example there was almost a 34 percent increase in the Dow from the end of 1957 to the end of 1958. That annual percentage increase was not matched even during any of the boom years of the last two decades.

The following graph matches the annual percentage increase or decrease of the Dow and industry combined ratio from 1958 to 2008.

The graph demonstrates that the annual percentage fluctuations in the Dow are more extreme than the fluctuations of the combined ratio. In order to match "apples to apples" and to better match the extent of the percentage declines and advances, the next graph reduces the Dow percentage by 2/3.

Correlation in the later years, from the 1980s to the present, suggest that insurers may be reacting more, or better, to changes in the stock market than they had in years past. The graph suggests (though doesn't conclusively prove) that in years the stock market increases, insurers are loosening underwriting standards in order to write greater premium dollars, which in turn increases investment capital. In years where the Dow has increased the combined ratio usually decreases, suggesting that insurers are tightening up underwriting standards in order to improve underwriting profit, and in doing so they are offsetting investment loss. The fact that the correlation seems to increase in the later years suggest that insurers are reacting more quickly due to the greater sophistication, faster communication, and superior information that are available to insurers in the computer age.

The following graph shows whether insurers are reacting to changes in the financial markets or are anticipating the changes. The following is a scatter graph of the 1980s to the present.

The triangles in the upper right quadrant represent years that both the industry combined ratio and the Dow go up in tandem. Triangles in the lower left quadrant represent years that both the CR and Dow go down in tandem. The graph indicates that generally when the Dow goes down, the industry reduces its combined ratio.

Of concern are the diamonds in the upper left quadrant. They represent the yeas that the CR increases the year before the Dow goes down. In such years insurers would have greater difficulty producing profits.

There is only one year when the CR went up when the Dow went down. There is only one year where the CR went down the year before the Dow went down.

Conclusion

The data suggests that the industry has done a good job of being reactive to the financial markets. It has not for the most part, however, been proactive.

The premise of this website is that financial markets will soon go down significantly. The evidence for this will be presented in future posts. If that does indeed occur, insurers will need to be prepared to tighten up underwriting and earn underwriting profits. They also need to be prepared to shift investments from stocks and most bonds to cash and interest bearing instruments (which will also be discussed in future posts).

The data suggests that the industry has done a good job of being reactive to the financial markets. It has not for the most part, however, been proactive.

The premise of this website is that financial markets will soon go down significantly. The evidence for this will be presented in future posts. If that does indeed occur, insurers will need to be prepared to tighten up underwriting and earn underwriting profits. They also need to be prepared to shift investments from stocks and most bonds to cash and interest bearing instruments (which will also be discussed in future posts).

In the event of a major economic downturn, some insurers will perform better than others. Those that are already moving toward lower combined ratios will likely be more successful.

Friday, September 10, 2010

Initial Post

This website is dedicated to an analysis of the property/casualty insurance industry using the Elliott Wave Theory.

The Elliott Wave Theory (EWT) is a form of technical analysis uses identifies socioeconomic trends, attitudes, and psychology. EWT is based upon the belief that these trends and attitudes are cyclical and follows relatively standard patterns. By analyzing both long-term and short-term term trends, EWT can be used to make forecasts regarding the financial markets as well as other activity prone to cycles.

In this first posting, I will briefly mention what I expect to occur based on an analysis using primarily EWT. In future postings, I will expand upon these forecasts and provide support for my assertions.

I expect the following to occur:

The Elliott Wave Theory (EWT) is a form of technical analysis uses identifies socioeconomic trends, attitudes, and psychology. EWT is based upon the belief that these trends and attitudes are cyclical and follows relatively standard patterns. By analyzing both long-term and short-term term trends, EWT can be used to make forecasts regarding the financial markets as well as other activity prone to cycles.

In this first posting, I will briefly mention what I expect to occur based on an analysis using primarily EWT. In future postings, I will expand upon these forecasts and provide support for my assertions.

I expect the following to occur:

- Before the year is over there will be a serious decline in the financial markets.

- The decline will be a full-blown depression that will last about five years.

- The insurance industry will fare better than other industries.

- There will be a reduction of the workforce in the insurance industry, but it will probably be to a lesser extent than other industries.

- Some insurance companies that are not prepared from the coming financial crisis will become insolvent.

- Companies that weather the economic storm will be poised for growth at the end of the depression.

- Insurance companies that tighten up their underwriting now will weather the storm better than those companies that do not.

- Though I don’t expect it to occur, companies that reduce their investments in stocks (and most bonds) to the lower limits allowed by state regulation, and rely primarily on achieving underwriting profits, would whether the expected economic trouble much better than those that don't.

- We will see a hardening of the markets.

- Insurance companies that weather the coming economic storm will be well poised for future growth.

- Individuals that have their 401ks invested in mutual funds will suffer from the economic downturn. They would be much safer moving their investments into the money market/cash options that are offered by most plans. If the downturn doesn't occur, the only thing that they would lose would be some potential profit. If they don't move their funds, they stand to lose their nest egg.

- There is no stock that stands out as a good "buy and hold" long-term investment right now. Going long may be a good idea as a short-term swing trade during brief rebounds.

Subscribe to:

Comments (Atom)