In James Olsen’s excellent textbook, Finance for Risk Management and Insurance Professionals (the required text for CPCU-540), he points to three factors that influence underwriting cycles. The factors are investment income, capacity, and return on equity. Olsen importantly points out that investment income can offset underwriting losses. It is investment income on which this report is focused (Note that both capacity and return on equity are both affected by investment income).

Though the financial markets have had their ups and downs, the Gross Domestic Product has grown steadily since 1956, from $437.4 billion, to $14.4 trillion in 2008. Not factoring for inflation, the GDP never went down in any single year – until 2009. The stock market too, trended upward as a "Supercycle" starting with the depths of the Great Depression and ending with the bursting of the Dot Com Bubble in March 2000.

The objective of this report is to analyze whether the underwriting cycle has moved in response to the financial markets.

When financial markets decline, it is indisputably beneficial for combined ratios to decrease. It can also be argued that profits can be maximized by increased combined ratios, during times of prosperity, in order to increase the availability of investment funds.

It should be emphasized, however, that stocks make up only about 10 - 12 percent of insurers' assets.

Analysis

This report (the first of two parts) compares the historical movement of the Dow Jones to the movements of underwriting cycles.

Combined Ratio information was gatthered from various editions of A.M. Best Company’s Best’s Aggregates & Averages.

Since the industry-wide combined ratio information is based on end of the year data, this report uses the Dow prices as of the last day of each year.

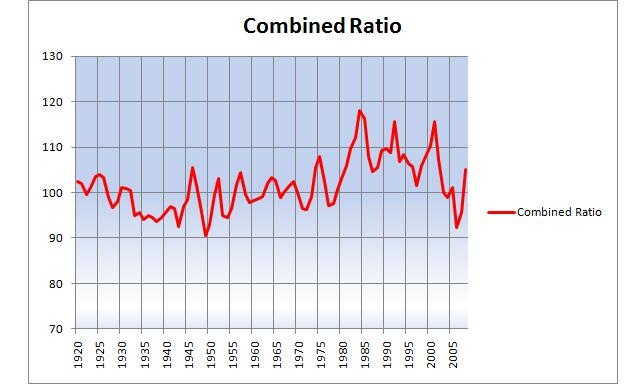

The following graph shows the industry-wide combined ratios from 1920 to 2008.

It is interesting to note that between 1929 and 1932, the first years of the Great Depression, The industry incurred an underwriting loss. It took the industry a few years to react (presumably by tightening underwriting standards), but by the worst year of the Depression, the industry started to turn things around. By 1934 the industry was making an underwriting profit of more than 4 percent. By 1935, the industry achieved a combined ratio of .94.

The next graph shows the performance of the Dow overlaying the graph of the combined ratios. Please note that the two charts are not to scale. The combined ratios operate in a narrow range, more or less, anchored to 1.0, while the Dow has increased so much over the last twenty years that even the Great Depression is hardly noticeable on the chart.

For example, in looking at the above graph it appears that there was little growth or volatility from 1956 to the late 1970s. Without taking a closer look, it would otherwise appear that insurers would not have needed to react to drastic changes in the financial markets during those years. However, the graph is deceiving. The earlier years look flat in this first graph not only because of the increase in real value, but also because of the inflation, wild fluctuations, and wild growth of the later years.

The following is a graph of the Dow from 1957 to 1967.

A closer inspection shows that there have significant percentage swings - smaller cycles comprising the larger supercylce. For example there was almost a 34 percent increase in the Dow from the end of 1957 to the end of 1958. That annual percentage increase was not matched even during any of the boom years of the last two decades.

The following graph matches the annual percentage increase or decrease of the Dow and industry combined ratio from 1958 to 2008.

The graph demonstrates that the annual percentage fluctuations in the Dow are more extreme than the fluctuations of the combined ratio. In order to match "apples to apples" and to better match the extent of the percentage declines and advances, the next graph reduces the Dow percentage by 2/3.

Correlation in the later years, from the 1980s to the present, suggest that insurers may be reacting more, or better, to changes in the stock market than they had in years past. The graph suggests (though doesn't conclusively prove) that in years the stock market increases, insurers are loosening underwriting standards in order to write greater premium dollars, which in turn increases investment capital. In years where the Dow has increased the combined ratio usually decreases, suggesting that insurers are tightening up underwriting standards in order to improve underwriting profit, and in doing so they are offsetting investment loss. The fact that the correlation seems to increase in the later years suggest that insurers are reacting more quickly due to the greater sophistication, faster communication, and superior information that are available to insurers in the computer age.

The following graph shows whether insurers are reacting to changes in the financial markets or are anticipating the changes. The following is a scatter graph of the 1980s to the present.

The triangles in the upper right quadrant represent years that both the industry combined ratio and the Dow go up in tandem. Triangles in the lower left quadrant represent years that both the CR and Dow go down in tandem. The graph indicates that generally when the Dow goes down, the industry reduces its combined ratio.

Of concern are the diamonds in the upper left quadrant. They represent the yeas that the CR increases the year before the Dow goes down. In such years insurers would have greater difficulty producing profits.

There is only one year when the CR went up when the Dow went down. There is only one year where the CR went down the year before the Dow went down.

Conclusion

The data suggests that the industry has done a good job of being reactive to the financial markets. It has not for the most part, however, been proactive.

The premise of this website is that financial markets will soon go down significantly. The evidence for this will be presented in future posts. If that does indeed occur, insurers will need to be prepared to tighten up underwriting and earn underwriting profits. They also need to be prepared to shift investments from stocks and most bonds to cash and interest bearing instruments (which will also be discussed in future posts).

The data suggests that the industry has done a good job of being reactive to the financial markets. It has not for the most part, however, been proactive.

The premise of this website is that financial markets will soon go down significantly. The evidence for this will be presented in future posts. If that does indeed occur, insurers will need to be prepared to tighten up underwriting and earn underwriting profits. They also need to be prepared to shift investments from stocks and most bonds to cash and interest bearing instruments (which will also be discussed in future posts).

In the event of a major economic downturn, some insurers will perform better than others. Those that are already moving toward lower combined ratios will likely be more successful.

No comments:

Post a Comment